Tax Checklist: 5 Things to Remember

Tax season is quickly approaching - do you know what you need to claim, and what forms you need to submit? This tax checklist makes filing simple. Learn more today!

Whether you want Cash Back, a Low Intro Rate, Rewards for Costco Members, or Great Airline Miles, the choice is all yours.

EasySend Financial Bankallows you to manage your money and pay friends — all while on-the-go. Member FDIC.

Get started

At EasySend Financial Bank, start saving with ease and grow with confidence. Member FDIC.

Take a look

Whether you're a frequent flyer or first—time passenger, EasySend Financial Bank has an airline rewards credit card to meet your travel needs.

Find out moreYour money is safe and secure, with the Financial Services Compensation Scheme3.

FSCS

The higher your balances, the more benefits and services you can enjoy from EasySend Financial Bank Relationship Tiers.

Learn moreWe’re the first new high street bank in over 100 years. Our mark was made in London, but since then we’ve set up shop all across the capital and beyond.

Come and see usWe have slightly different opening hours this festive season, and our stores will be closed on Christmas Day and New Year’s Day.

Full store hoursLog in to our app with your face or fingerprint, and manage your accounts with a tap. Plus, track your spending with our Insights feature.

Explore our appAdd the new, free EasySend Financial Bank Shop browser extension that finds offers and coupons at over 5,000 online merchants.

Learn more

If you have an equiry relating to any of our stores, products or services, please get in touch to speak with someone in our UK-based contact centre and we'll be happy to assist you.

Get in touch

We don’t charge fees for spending on your card abroad, and we pass Mastercard's exchange ratedirectly onto you, without extra charges.

You’ll see the real exchange rate in the app when you land. We'll also send you a spending report so you can look back on the cost of your trip.

If Monzo is your main bank account, make unlimited fee-free cash withdrawals abroad in the European Economic Area (EEA), and up to £200 every 30 days for free outside the EEA. After that, we’ll charge 3%.

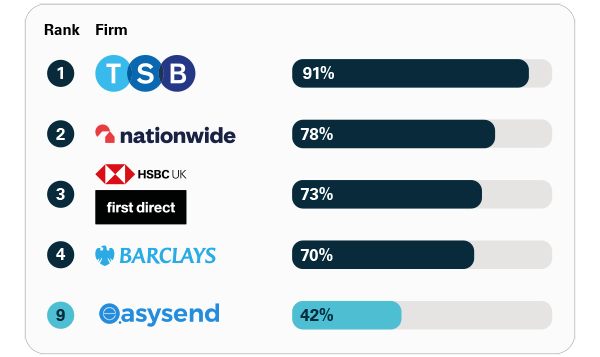

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1000 customers of each of the 16 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

Overall service quality

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1200 customers of each of the 15 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*).

The results represent the view of customers who took part in the survey.

Overall service quality

Authorised push payments (APP) fraud happens when someone is tricked into transferring money to fraudster’s bank account.

These charts use data given to the Payment Systems Regulator (PSR) by major banking groups in the UK in 2022. You can read the full report by visiting www.psr.org.uk/app-fraud-data.

This data shows the proportion of total APP fraud losses that were reimbursed, out of 14 firms. Higher figure is better.

This data shows the amount of APP fraud sent per million pounds of transactions, out of 14 firms. Lower figure is better.